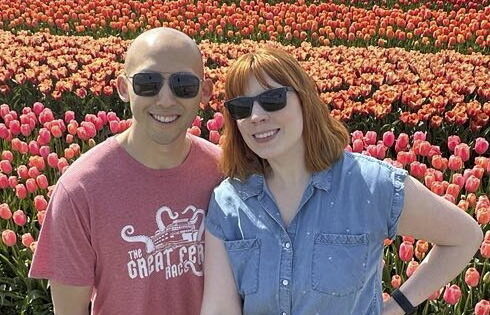

A pair of individuals claim they turned into millionaires within six years by embracing thrift store shopping and purchasing from discounted grocery outlets.

Emily Egashira, aged 34, stated that she adopted frugality out of necessity following her upbringing in impoverished conditions.

During her teenage years and into her early twenties, Emily juggled three jobs but still found it difficult to make ends meet – thus, she turned to using coupons.

Emily began her career in social media marketing with an earnings of $30K and eventually reached $200K, yet she remained committed to living frugally and prioritized saving money throughout her journey.

Currently, Emily and her spouse, Kenji Egashira, aged 35, who works as a gaming content creator, aspire to put away half of their monthly earnings into savings.

This has enabled them to save approximately $10k on average and achieve millionaire status within six years.

Emily, a content creator from Seattle, Washington, stated: “Our thriftiness and smart financial practices coupled with our stable careers fast-tracked our path to millionaire status.”

If we followed the usual Joneses approach, continually elevating our standard of living and surviving from one paycheck to the next, I would remain trapped in the endless cycle of the corporate world just to cover expenses and end up as a stressed-out mess.

“A few of my everyday thrifty practices involve purchasing from discounted supermarkets, preparing large quantities of meals in advance, and storing them for future use.”

I frequently review my budget and look for opportunities to reduce expenses, repair and maintain the things I own, and join in at my community’s buy nothing group.

When it comes to enjoying life without spending much, I really enjoy scavenging at thrift stores, attending garage sales, organizing potlucks or swaps with my buddies, joining free nearby activities, and exploring exciting places within our gorgeous province.

Initially, Emily began practicing thriftiness out of necessity during her teenage years and into her twenties.

She confessed that she was “b broke” and frequently had to depend on couponing and “TV dinners” to make ends meet.

Emily mentioned, “During my upbringing, I experienced poverty multiple occasions, and once I left home at 17 and into my early twenties, I became quite frugal.”

I had no money, juggling three jobs and surviving on frozen meals.

I recall my mother frequently using coupons when I was young, so I made sure to purchase the most affordable items available with discounts.

As I grew older and began earning more income, I opted for frugality as a way of life.

I realized that the daily corporate routine wasn’t my cup of tea, and I was tired of feeling pressured about finances.

Emily subsequently secured a position in social media marketing and resolved that both she and her spouse would begin setting aside a minimum of 50 percent of their earnings each month — approximately $10k monthly.

By combining savings strategies such as thrift store purchases, discounted shopping, and obtaining items for free from their neighbors, the couple managed to amass a fortune of over a million dollars.

Emily mentioned, “I began managing my finances by setting up a savings buffer for emergencies, shopping second-hand more often, and modifying my daily habits and expenditure patterns.”

I ultimately discovered the Financial Independence, Retire Early (FIRE movement), and it provided the solution I had been seeking all along – freedom.

Ever since then, my spouse and I strive to set aside a minimum of half our earnings—reaching as high as eighty percent at times—and the sense of tranquility this brings me is beyond measure.

Emily stated that being thrifty doesn’t equate to being stingy since those who practice thrift can still prioritize quality and value.

She mentioned that both she and Kenji plan to continue spending money, albeit “consciously,” which includes expenses like traveling, purchasing experience days, and using non-essential services.

Emily mentioned: “A key strategy for conserving funds is to maintain a lifestyle within your budget – essentially, this means spending less than what you earn.”

To create the greatest effect, begin by concentrating on cutting down the three largest expenses in most individuals’ budgets — which include housing, transportation, and food.

Indulge in your small coffee delights occasionally, and concentrate on reducing costs that will have the most significant impact.

Strive for equilibrium, rather than restriction.

A financial plan or way of living that makes you feel as though you’re denying yourself isn’t likely to last.

I suggest folks try a values-driven budgeting approach. This involves reducing expenses on items that aren’t particularly important to them—such as clothing and vehicles for me—and instead investing more in activities that provide happiness and significance, such as exploring new destinations, going on trips, or treating themselves occasionally.

Emily’s top advice for adopting an economical way of life –

1 – Spend less than you earn

2 – Strive for equilibrium, rather than restriction

3 – Think about the five R’s prior to purchasing: reject, decrease, utilize again, compost, and adapt.

4 – Resist the urge to increase your spending habits whenever you receive a salary bump.

Emily is offering her insights and strategies on

@heyfrienditsem