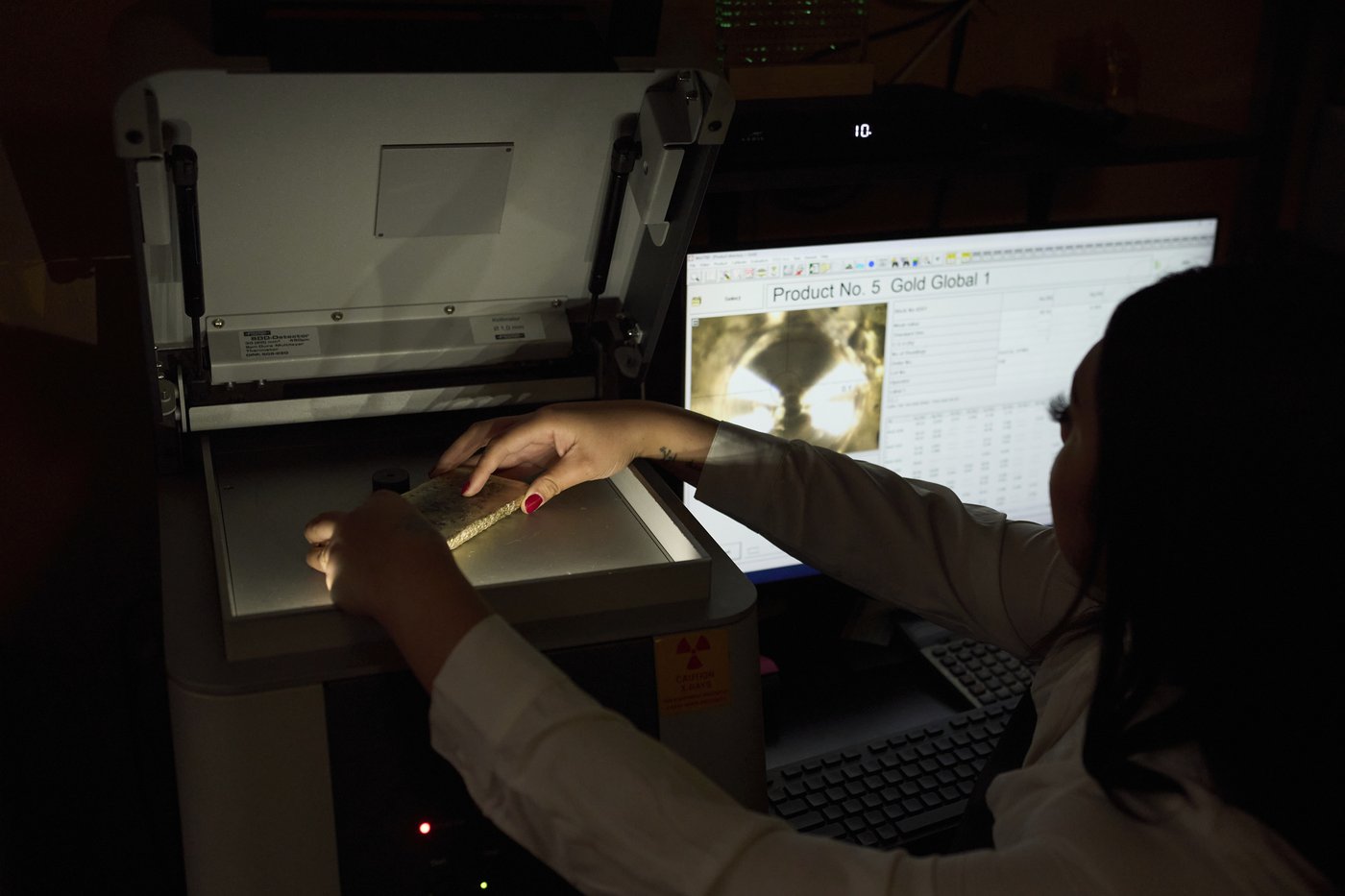

LOS ANGELES (AP) — At the largest jewelry hub in the U.S., Alberto Hernandez started his machinery recently and waited for it to turn a glowing orange hue before inserting a variety of rings, earrings, and necklaces with a total weight similar to that of a soap bar: roughly 100 grams or 3.2 troy ounces.

Minutes later, the bubbling liquid metal was cooling in a rectangular cast the size of a woman’s shoe. An X-ray machine determined it was 56.5% gold, making it worth $177,000 based on the price of gold that day.

As gold prices

soar to record highs

Amid worldwide financial uncertainties, hundreds of thousands of dollars in gold pass through the doors of St. Vincent Jewelry Center in downtown Los Angeles each day.

A significant number of the 500 individual occupants at the center, including jewelry makers, gold refineries, and testers, report experiencing an unprecedented rise in clientele.

Currently, we’re observing many rappers and similar individuals liquefying their large items,” explained Alberto’s nephew, Sabashden Hernandez, who is employed at A&M Precious Metals. “We’ve acquired numerous new clients who are simply converting all of their grandparents’ possessions into liquid form.

Gold’s

current rally

comes as President

Donald Trump

issues ever-changing

announcements on tariffs

, turbulent financial markets and posing a threat to

reignite inflation

.

As a result, individuals nationwide are rushing to offload or smelt their outdated jewelry for some swift cash, with intermediaries such as pawnshop proprietors leading the way. Meanwhile, others believe their funds may be more secure in precious metals rather than in an unpredictable equity market, thus driving demand by acquiring gold at an equally rapid pace.

Los Angeles jeweler Olivia Kazanjian said people are even bringing in family heirlooms.

“They’re using their family’s wedding dates and items from the 1800s to melt things,” Kazanjian stated.

She recently compensated a client for a 14-karat gold bracelet featuring elaborate blue enameling, which can also function as a brooch. The customer left with $3,200 based on the weight of the gold within the item measured in troy ounces—the common unit for valuable metals, equating to approximately 31 grams.

However, Kazanjian has no intention of melting down the piece. She emphasized that its true artistic and historical significance far surpassed this action.

It’s simply remarkable… and such artistry isn’t seen much these days,” Kazanjian remarked, mentioning she has convinced several clients not to melt down the pieces. “This item represents a part of history, and if you’re fortunate enough to have inherited it, it becomes a connection to your family heritage.

Companies involved in the sales aspect of this activity, providing gold bars and various materials, are also exerting significant effort to meet the demands of the craze.

Items come in and they go right back out,” stated Edwin Feijoo, owner of Stefko Cash for Gold in Pennsylvania, who handles deliveries from clients throughout the U.S. eager to sell their gold. “Everyone seems quite occupied at present.

However, business hasn’t been prosperous for everybody.

For certain jewelry makers sourcing items from overseas locations such as Italy, Turkey, and China, the dual impact of elevated gold costs and additional duties has narrowed profit margins and reduced customer interest.

“Our profit margins are extremely narrow here,” stated Puzant Berberian, who comes from a family that established V&P Jewelry within St. Vincent back in 1983. He mentioned that he had to pay an additional $16,000 for a shipment coming from abroad not too long ago.

Customers are experiencing “sticker shock” as they find themselves unable to afford items they once could. For instance, a substantial 14-karat gold bracelet, tipping the scales at approximately 10 grams (0.32 troy ounces), would typically have been priced around $600 last year; however, it has surged up to nearly $900 nowadays, according to Berberian.

A few think these tendencies might persist, affecting both individuals and companies alike.

According to Sam Nguyen, customers looking to purchase bullion believe “that gold prices will increase further.” His company, Newport Gold Post Inc., which has been dealing with gold and other valuable metals at St. Vincent for half a decade, supports this view. Despite cooling down from its peak price of $3,500 per troy ounce, Nguyen anticipates that gold might hit between $4,000 and $5,000 by the close of the year.

Jeff Clark concurs. As the founder of The Gold Advisor, an organization offering investment guidance, he doesn’t find it surprising that gold prices might keep climbing because this precious metal serves as a refuge for investors looking to secure their wealth during uncertain times.

concern over a potential economic downturn

.

History indicates it has been even higher before,” Clark stated, alluding to the boom in the 1970s when the typical gold price surged twentyfold during periods of high inflation. “Should apprehension and ambiguity persist among the public, we can expect these prices to continue rising.

Jamie Ding, The Associated Press